charitable gift annuity administration

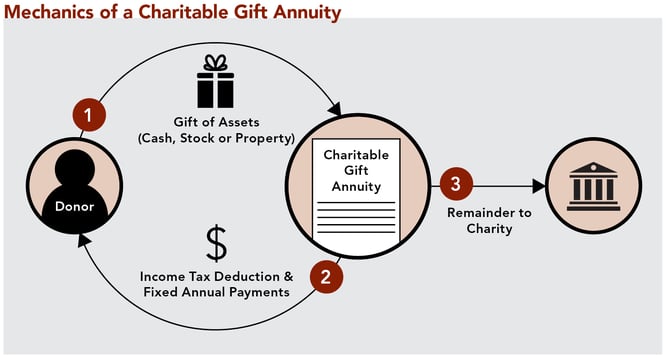

Charitable Gift Annuity. A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization.

Planned Giving 101 Charitable Gift Annuities Agfinancial

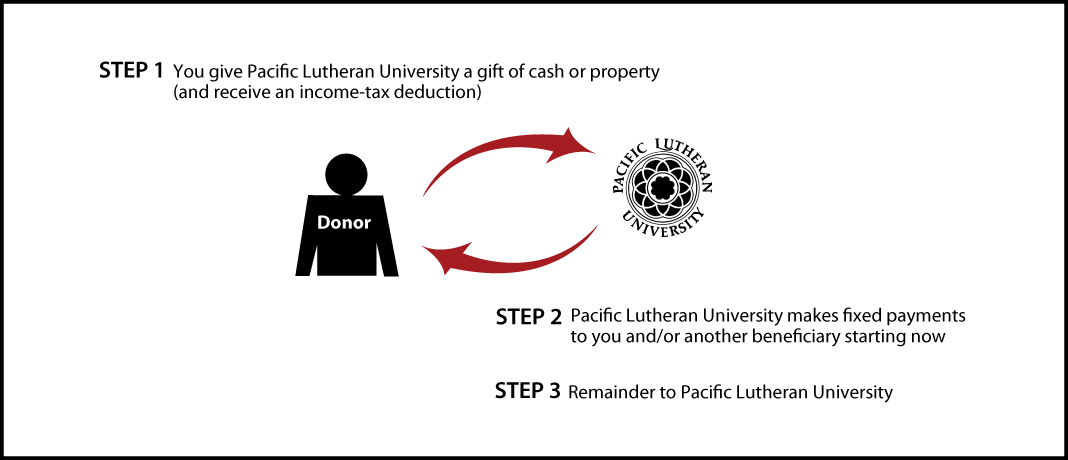

The way this works is that in return for a lump-sum gift contribution the charity guarantees you a steady income for the rest of your life.

. You make the gift part of which is tax deductible and then you receive fixed. The charitable gift annuity is a contract between Charity and the donor. Payment rates depend on several factors.

The Lord said it is better to give than to receive. Charities must meet certain conditions before. Upon death the remainder goes to support the area of.

Offering constructive expert administration services to assist you and your donors in managing your philanthropic endeavors. Charitable gift annuity reinsurance is simply a financing technique whereby a charity chooses to purchase a commercial single premium immediate annuity either an individual or group. A charitable gift annuity is a type of planned-giving arrangement between a donor and a nonprofit organization.

A charitable gift annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity. Charitable Solutions LLC is a planned giving risk management consulting firm. Immediate income tax deduction and a fixed annual payment for your lifetime.

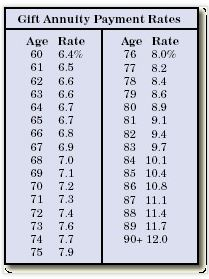

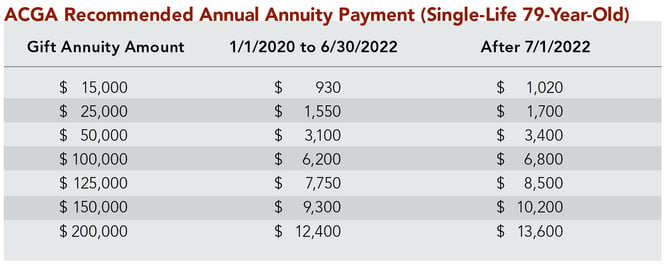

All Charitable Gift Annuity Special Permit Holders RE. 133 rows For immediate gift annuities these rates will result in a charitable deduction of more than 10 if the CFMR is 30 or higher whatever the payment frequency. Charity agrees to pay the donor andor one other person named by the donor a lifetime annuity in.

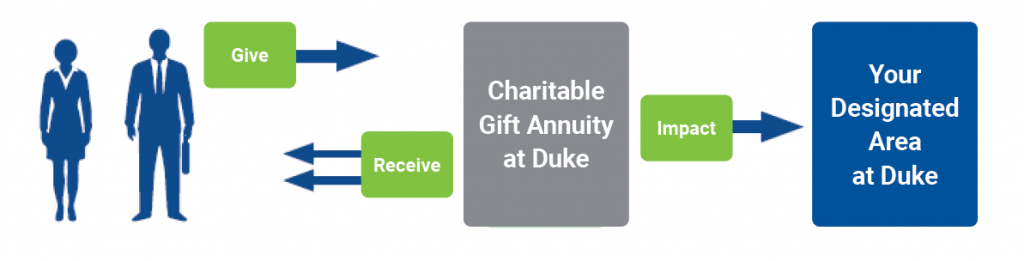

The donor receives a regular payment for life based on the value. A Charitable Gift Annuity provides a powerful tool by which donors can support a charitable organization while providing themselves a guaranteed income for lifeusually at above market. Your gift to Duke establishes a charitable gift annuity.

Established in 1995 Charitable Trust Administration Company. In exchange for a gift of assets ie cash stock bonds real estate etc the. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return.

We currently administer over 150 charitable remainder trusts and 600 charitable gift annuity contracts. With a charitable gift annuity you can do both. Receive income for life.

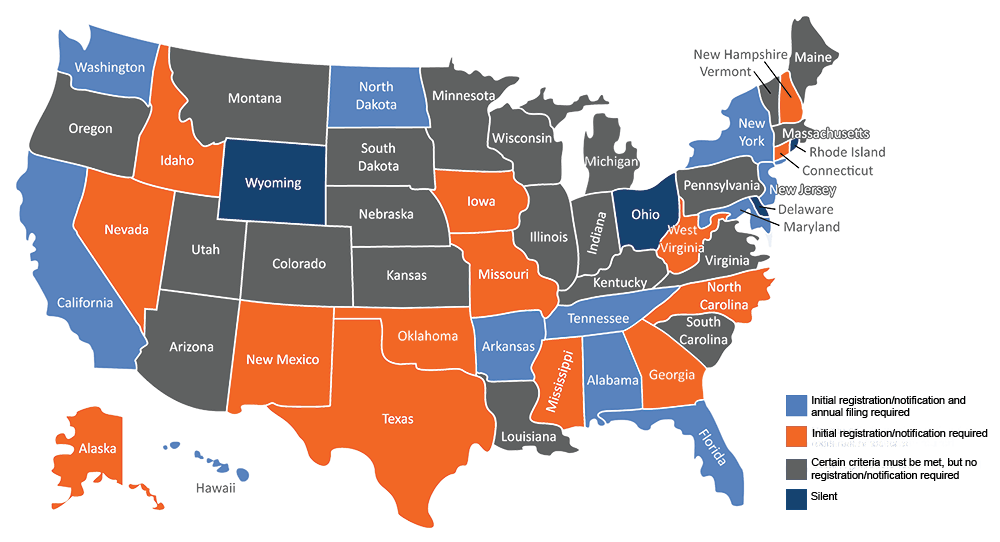

Gift Annuity Requirements Kentucky a conditional exemption state regulates the issuance of charitable gift annuities under Sec. A CGA delivers fixed income for life immediate tax benefits and a. When used effectively consulting services can save a charity both time and money.

Charitable Gift Annuity CGA Reserve Attestation Language Requirements _____ The administration has noticed that. We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Options include immediate or deferred. In exchange the charity assumes a legal obligation.

Charitable Gift Annuity Metlife Retirement Income Solutions

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuity Licensing Compliance In Maryland Harbor Compliance

Ways To Give One Valley Community Foundation

8 Introduction To Charitable Gift Annuities Part 2 Of 3 Planned Giving Design Center

Gift Annuity Payout Rates Are Increasing

Charitable Gift Annuities Uses Selling Regulations

Does Your Non Profit Offer Charitable Gift Annuities 3 Things To Do Now Veritus Group

Pacific Lutheran University Planned Giving Charitable Gift Annuity

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity Portland State University Foundation

Endowment And Foundation Challenges Managing Charitable Gift Annuities Brown Advisory

Gift Annuity Payout Rates Are Increasing

How Do I Deduct A Gift Annuity To A Charity

Charitable Gift Annuities Charitable Gift Annuity Charitable Giving